Automation, digital technology, and a pandemic-driven tectonic shift in buyer behavior have transformed today’s B2B payment practices: this is not your father’s finance department. The rapid changes can be disorienting, but there is a cure. Read on to learn the skills, systems, and strategies to help your business adapt and thrive as B2B payment processes evolve.

Key Takeaways:

- 5 ways automation and digital technology can dramatically increase efficiency and reduce costs

- How digitization can help businesses deliver a first-class customer experience

- 3 ways automation can decrease the risk of fraud and offer more secure business transactions

- How to streamline payment operations in 6 simple steps

- What enables a company to scale its financial operations successfully

Sign up for a Free Trial today.

SHORTCUTS

-

How does the accounts payable process work?

-

5 Opportunities to increase efficiency and reduce costs

-

Optimizing payment operations by streamlining processes

-

How to streamline work in payment operations

-

How buyers and suppliers can benefit from faster, smarter payments

-

6 Benefits of efficient receivable processes for suppliers

How do businesses pay other businesses?

B2B payments exchange currency for goods or services between two businesses. Depending on the contractual agreement between the buyer and supplier, B2B payments can be a one-time or recurring transaction. Paper checks, ACH payments, wire transfers, credit cards, and cash are the most common B2B payment methods.

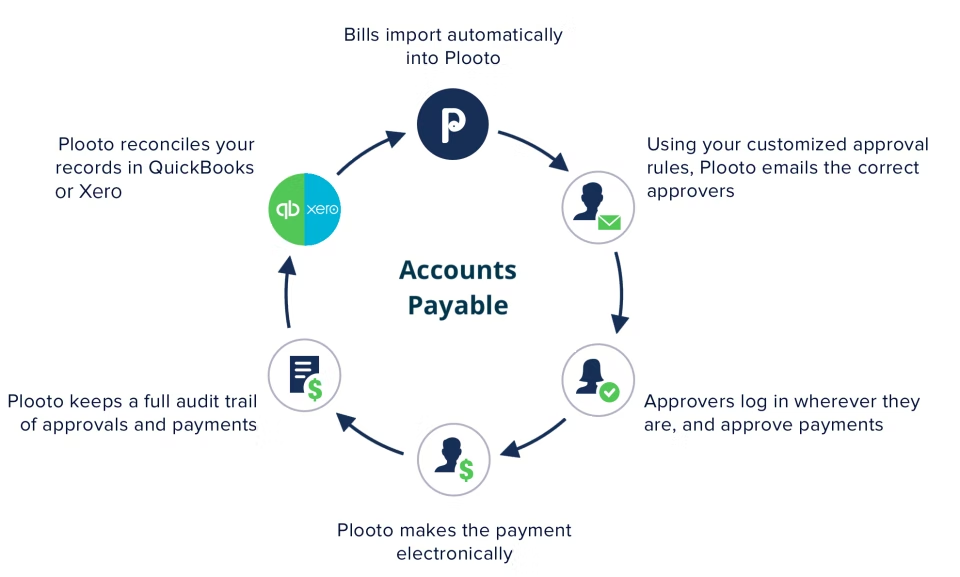

How does the accounts payable process work?

The accounts payable (AP) process includes the following accounting activities needed to complete a purchase when a customer places an order and receives the desired product or service:

- Invoice data capture

- Coding invoices with the correct account and cost center

- Approving invoices

- Matching invoices to purchase orders

- Posting for payments

The AP process includes three key documents: purchase order (PO), receiving report (or goods receipt), and vendor invoice. To trigger an order, the organization’s purchasing department sends a PO to a vendor detailing the requested merchandise, quantity, and price. When the business receives the goods, a receiving report documents the shipment—including any damages or quantity discrepancies. The vendor then sends an invoice requesting payment for the goods or services provided. The AP department receives vendor invoices, and the invoice management process begins.

The AP department’s two main goals are to ensure only authorized and accurate invoices are paid, and to find savings opportunities, such as through early payment or dynamic discounting.

Note: The accounts payable process is part of the larger AP cycle, also known as the procure-to-pay (P2P) cycle.

What is the P2P cycle?

P2P is the complete cycle of actions and events a business engages in when purchasing goods or services from an outside supplier. P2P involves four key stages: selecting goods and services; enforcing compliance and order; receiving and reconciliation; invoicing and payment—less any discounts and adjustments. Ideally, P2P integrates purchasing and accounts payable systems to create greater efficiencies.

AP vs. AR: what’s the difference?

AP is what you owe suppliers or service providers for products received or services rendered. Because it is money owed, AP is considered a liability. Accounts Receivable (AR) is money owed to you for goods or services you provided to your customers on credit. AR is treated as an asset, representing how much money your customers owe you.

What is invoice processing?

Invoice processing involves the complete cycle of receiving a supplier invoice, approving it, establishing a remittance date, paying the invoice, and then recording it in the general ledger (GL). Steps include:

- Matching the invoice contents received with the original purchase order sent to the supplier to verify the basic details.

- Forwarding invoices to authorized approvers to approve or reject invoices.

- Authorizing and submitting invoices for payment in a financial system.

- Processing invoices for payment via common payment methods—check, ACH, or wire transfer.

- Archiving invoices and payment information in the GL and for audit purposes.

What is payment processing?

Payment processing is how businesses complete credit card and debit card transactions. Payment processing services expedite card transactions, and payment gateways securely transmit data so money from a customer’s issuing bank can be transferred to a merchant’s account.

What is payment reconciliation and why is it important for businesses to reconcile transactions regularly?

Payment reconciliation is an accounting process that verifies account balances to ensure all sets of records are accurate, consistent, and up-to-date. Businesses can reconcile their accounts daily, weekly, or monthly. Ezidebit writes that reconciliation can help:

- Identify errors sooner rather than later, ensuring a faster resolution and improved cash flow.

- Catch unauthorized payments or a security breach at your banking institution.

- Make sure every missed or late invoice is followed-up and settled.

- Ensure your company’s financial records are accurate.

Without accurate financial records, you cannot monitor your business’ health, make informed business decisions, or show your financial standing to banks, investors, and lenders. Also, in industries with record-keeping and regulatory requirements, accuracy is crucial to maintaining compliance and protecting your business against penalties.

What is the difference between remittance and payments?

A remittance is one party sending money in payment for goods or services or as a gift to another party, usually one in another country. You can send remittances via a wire transfer, electronic payment system, mail, draft, or cheque. You can use remittances for any type of payment, including invoices for business purposes or other obligations like personal transfers made to family and friends. Typically, the difference between a remittance and a payment is whether money crosses borders.

Treasury management and working capital management

Working capital management (WCM) is short-term financial planning—the tactics and tools needed to manage an organization’s cash needs over the upcoming 12 months. Working capital is a company’s current assets minus its current liabilities. WCM is part of the much larger treasury management system. Treasury management optimizes your business’s liquidity while mitigating financial, operational, and reputational risk.

💡 “By incorporating Plooto in his tech stack, Envolta can make even complicated approval and payment workflows easy, efficient, and 100% virtual.”

Envolta Grew Revenues 400% Using Plooto’s AP Automation in the Cloud

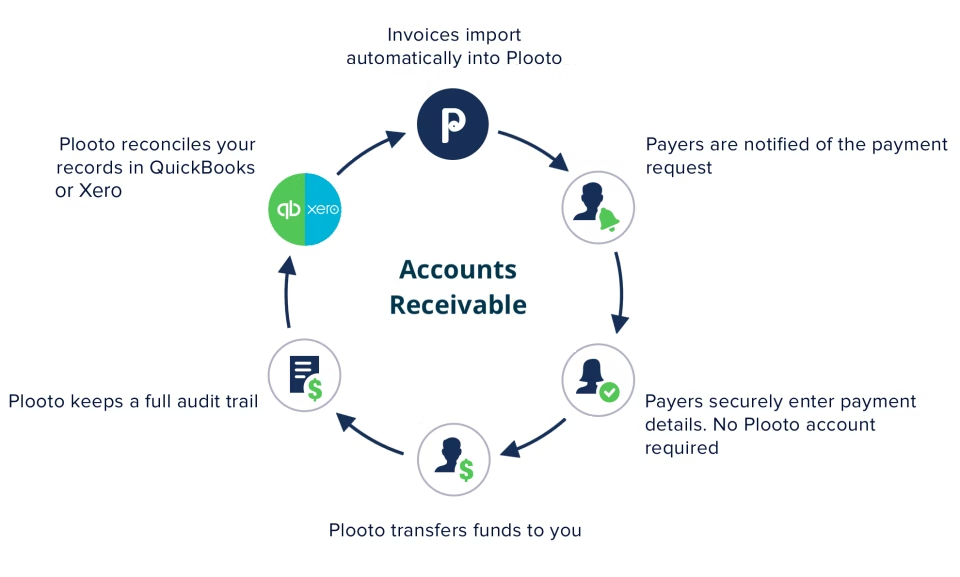

How the Accounts Receivable process works

AR refers to all the outstanding invoices that have been sent to the client but have not been paid. An AR workflow is the step-by-step process to record and collect the debt. A typical AR workflow includes:

- Communicating with a customer regarding a product or service resulting in a sales/delivery

- Establishing credit practices

- Invoicing the customer

- Invoice Tracking

- Payment collection

- Reconciliation

Additional activities could include:

- Sending payment reminders

- Sending late payment reminders

- Escalating the matter further if the customer does not make payment

How can businesses improve their payment processes?

Adopting a digital invoicing system helps streamline all AP steps, prevent errors, and shorten payment times. Digital invoices are also easier to track and store.

5 Ways to increase efficiency and reduce costs

Digitizing the AP workflow is key to streamlining the B2B buying experience. B2B payment processes that rely on manually processed invoices and paper checks are inefficient, error-prone, and unable to capture and integrate valuable customer data directly into AP and AR systems.

Digitizing AP and AR systems increase efficiency and reduce costs by:

1. Eliminating paper

“The number one challenge for organizations today in AP is difficulty finding or managing paper-based documents.” (Aberdeen Group, 2014).

2. Eliminating manual processes

Manual invoice entry can cause errors that corrupt cash flow forecasting, or lead to costly mistakes such as duplicating payments or overpaying.

3. Reducing long cycle times

Eliminating manual processes to send an invoice can drastically speed up delivery and shorten billing cycle time.

4. Eliminating poor cash flow visibility

Having a clear idea of inflow and outflow contributes to informed decision-making regarding planning, growth, and investments.

5. Replacing fragmented systems with digitized workflows

Replacing fragmented systems with digitized workflows that capture and integrate valuable customer data directly into your AP and AR systems.

Optimizing payment operations by streamlining processes

Streamlining processes is the strategy of removing complex or unnecessary steps to make your business more efficient.

Key benefits of streamlining processes include:

Increased cost efficiency

Streamlining software and automation reduce the use of paper and data entry demands.

Improved productivity

Eliminating nonessential tasks allows employees to focus on work that contributes to the company’s success.

Improved communication

Streamlined management systems sharpen coordination between departments and enable better tracking of tasks.

Reduced risk

Streamlined processes support greater transparency across the business.

How to streamline work in payment operations

- Document and assess existing processes and workflows

- Rank processes

- Analyze the tangible outcomes and quantifiable results of those processes and workflows

- Ask for feedback from colleagues, coworkers or employees

- Research workflow software solutions that help streamline processes and workflows

- Implement and make continuous process improvements

How buyers and suppliers can benefit from faster, smarter payments

Easy payments for buyers

Offering multiple payment plans help meet the specific needs of different customers:

- Make larger purchases more accessible

- Attract a wider range of buyers

- Promote repeat business

- Build customer loyalty

- Increase shopper's purchase power

Flexible payment plans can also:

- Increase conversion rate

- Increase sales per customer

- Improve the overall user experience

Go back to Shortcuts.

6 Benefits of efficient receivable processes for suppliers

Businesses that consistently receive late payments can suffer from poor cash flow, compromising planning, forecasting, and business growth. The reality is that the success of your business is based on accounts receivable getting paid faster, more efficiently, and with fewer errors.

Automating AR:

- Reduces costs of payment processing and saves time

- Results in better cash flow as quicker invoice creation yields faster payment collection with shorter days outstanding

- Enhances customer service by consolidating and enabling easy access to AR-related customer data

- Reduces the potential for human errors, leading to greater consistency and accuracy

- Ensures transparency as all invoices are tracked carefully, and ad hoc reports, real-time dashboards, and other automated tools provide transparency across the entire AR cycle

- Enables greater security and compliance with E-invoicing real-time electronic submissions

- Offers the potential to deliver critical insights and uncover opportunities for a business to improve cash management

What is payment certainty?

Payment certainty is reliable knowledge about a payment's status: the amount and availability to the intended recipient. Payment certainty answers the question: Are there good funds when the money is available?

1. Better Working Capital Management

The primary purpose of working capital management is to ensure the company maintains sufficient cash flow to meet its short-term operating costs and short-term debt obligations by operating efficiently. By proactively monitoring its assets and liabilities, the company achieves better working capital management.

Working capital is made up of the company’s current assets minus its current liabilities.

The four main components of working capital are:

- Cash and cash equivalents

- AR

- Inventory

- AP

Cash, AR, and inventory are three items in your company’s asset column, while AP is a liability.

2. Greater Control over Payments

Automation and digital technology help finance departments deliver greater payment control. Today’s B2B vendors want choice in how they receive payment. A digital infrastructure facilitates the use of ACH, credit and debit cards, digital checks, electronic bank transfers, mobile payments, and wire transfers.

Security is paramount as payment fraud continues to grow and become more sophisticated. Digital technology creates a more secure transaction. There’s no risk of losing a check in the mail. You’re alerted of a duplicate invoice. And there’s the added control of being able to schedule when your vendors receive their invoice payments.

Procurement process internal controls create a system of checks and balances to prevent fraud, reduce duplicate payments, minimize human errors, and ensure regulatory compliance. Automation and digitization are key to dramatically elevating the level of internal quality controls.

3. Digitally Enhanced B2B Customer Service

Consumers expect the businesses that serve them to know and meet their needs while providing a positive, simple, “frictionless” experience. That commitment to customer service is now being felt in B2B commerce.

Michael Vittum, senior manager and go-to-market lead for payments and commerce at HubSpot, told PYMNTS in a recent interview: “Buyers of B2B technology expect to have the same quick, seamless experience that matches [business-to-consumer] experiences offered by companies like Amazon or DoorDash. The pandemic drove this gigantic shift in buyer behavior, and businesses must adapt to that in the post-pandemic world.”

Digital technology enables businesses to access data and analytics about customer journeys, sales, and services. With this information, companies can provide B2B customers with an even better experience, generating new and repeat sales and increased market share. In addition, digitization offers B2B customers the convenience and flexibility of multiple payment methods, multiple channels, and greater security.

4. Richer data exchanges, more effective marketing

Data exchange is when two or more partners agree to exchange one or more identified sets of data and related attributes. The term rich data is the concept of data that conveys the intricacies of what is being studied. Rich data also refers to the range and diversity of data and data sources. Rich data can help businesses answer specific questions about their markets by linking the data available from multiple and varied sources. For example, rich data enables a company to see all the factors that influenced successful sales, including financial data—offer, channel, and payment method.

5. Scalability

A scalable business model implies that a company can increase sales given increased resources. Using the right technology strategically to drive performance—streamlining processes, creating greater efficiencies, reducing costs, achieving greater visibility—enables a company to scale its financial operations.

6. B2B Payment automation and mitigating risk

Providing superior security is critical to the success of any business. It’s especially acute for B2B businesses that often deal with high-value orders and offer multiple payment options. Companies with manual, paper-based processes of capturing, approving, and paying invoices are particularly open to fraud. Adopting an automation process can decrease the risk of fraud exposure and offer more secure business transactions by:

- Centralizing all accounts payable activity through one online process, giving accounting managers complete visibility into every payment at every step of the process.

- Setting up automated payment controls in the AP process to establish proper checks and balances.

- Making it easy to shift spend away from paper checks by providing accounting teams with easier access to electronic payment methods.

Terms you need to know

Payment Operations (PaymentOps)

The payment operations workflow involves managing the entire cycle of money movement: initiating payments, setting up approval processes, tracking and attributing sent and received funds, resolving payment failures and returns, reconciling transactions to bank statements, and booking payments to the GL.

See Payment Approval Workflows that Increase Business Efficiency for a more in-depth look at approval processes.

Cash Management

Cash management is the process of managing cash inflows and outflows. It is a key aspect of an organization's financial stability.

B2B Payment Solutions

A B2B payment solution is any tool—software or hardware—that makes it easier for small businesses to receive, make, or process payments.

Intelligent Data Capture (IDC)

IDC is the automated process of identifying and extracting critical information from incoming paper and electronic documents without manual intervention.

Once treated as an immutable business function, B2B payments has become a vanguard of change: highly automated, digitally driven systems create efficiencies, lower costs, and provide superior security. Companies failing to streamline their payment processes, leverage technology, and respond to changes in buyer expectations, will be unable to compete and move ahead.

Sign up for a Free Trial today

CHAPTERS

00 Everything you need to know about today's B2B payments

01 Rethinking B2B payment processing

02 From pain to gain: Solutions for Accounts Receivable problems

03 How AP teams are solving their toughest problems